Journey’s identity platform and patented Zero Knowledge Network® establishes ultra high veracity identity of customers and employees. Easily deploy secure voice, digital, in-person interactions without exposing employees to sensitive information.

Journey’s innovative identity platform enables composable identity experiences that can be tailored to achieve the level of security and veracity desired for any given voice or digital interaction. Journey’s identity network applies cutting edge cryptography and privacy, for fast and secure data validation across all user endpoints and contact center channels.

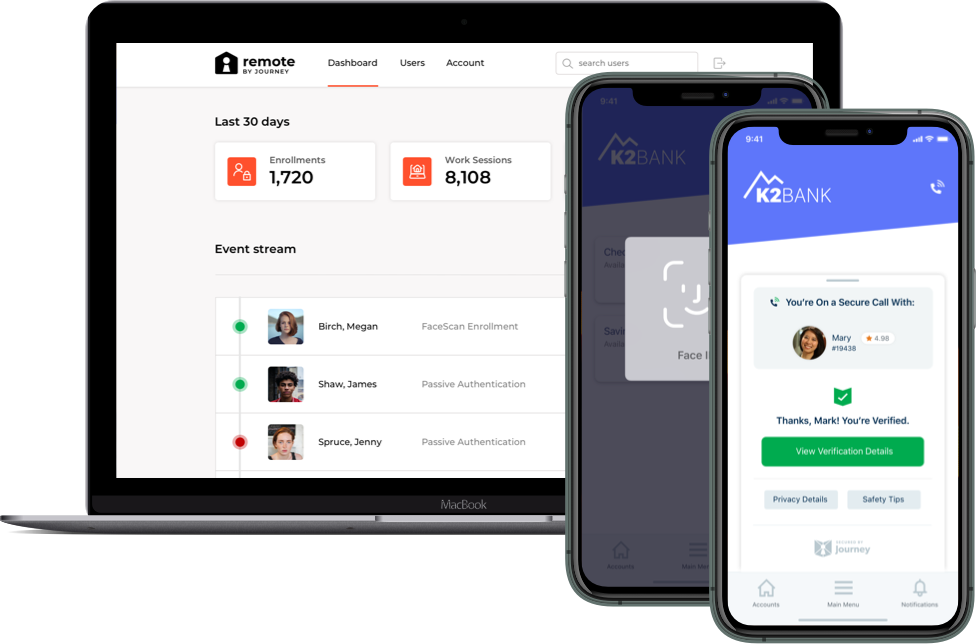

Ensure only your employees are sitting in front of their screens

Replace username and passwords with biometric authentication to gain entry to corporate networks.

Fill out the form below, and we'll send you more information on Secure Remote Workers.

Crush contact center KPIs with faster call handle time, better security and an award-winning customer experience

Unlock significant time and cost savings by making ID verification and authentication faster and far more secure.

Fill out the form below, and we'll send you more information on Contact Center Efficiency.

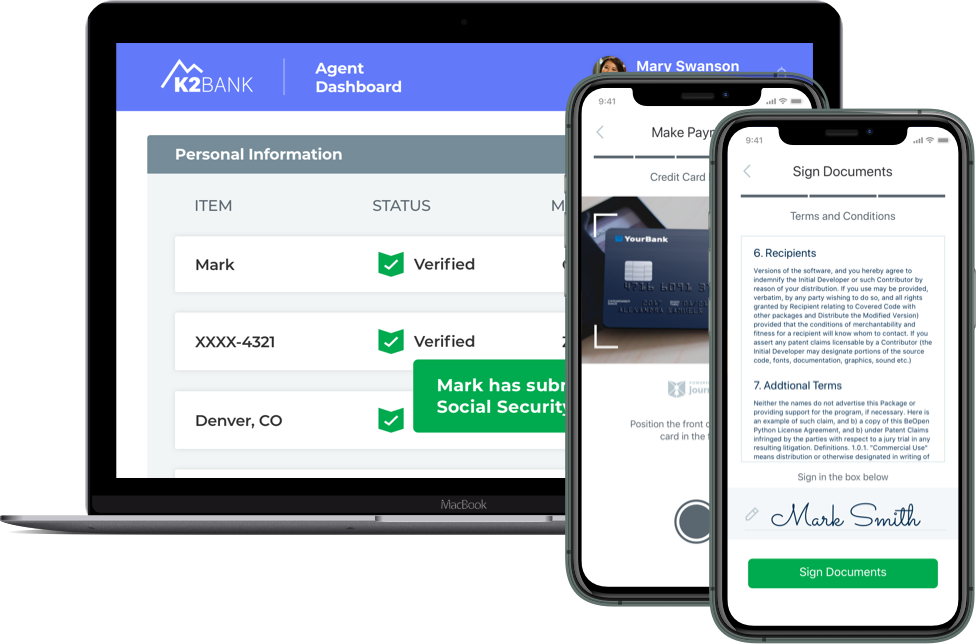

Journey’s secure payment solution vastly reduces the scope of compliance and eliminates card info on agent screens.

Our solution solves for PCI compliance and eliminates the need to send customers to a frustrating IVR system hoping they complete the payment.

Fill out the form below, and we'll send you more information on PCI Compliance.

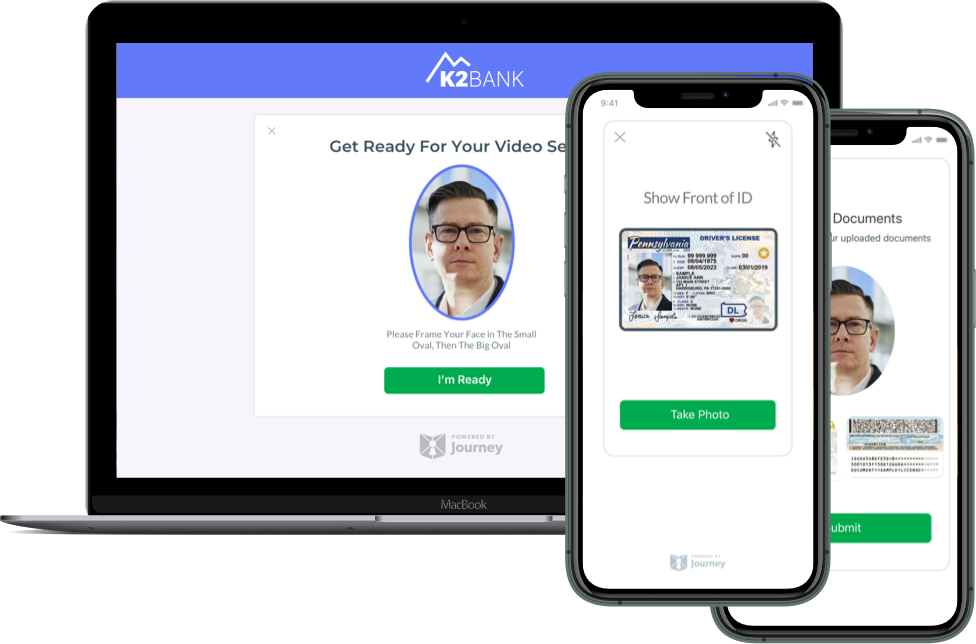

Identity verification and everyday authentication create ultra high veracity identity in voice, digital and in-person interactions

Journey’s trusted identity solutions span the entire customer lifecycle and provide a seamless experience via voice, browser, enterprise app or in-person

Fill out the form below, and we'll send you more information on Seamless Authentication Across Channels.

Reduce the scope of compliance for the growing number of consumer privacy regulations, like GDPR, CCPA and HIPAA

Journey is architected with consumer privacy as a top priority. By making interactions “Zero Knowledge,” sensitive personal information is verified, but not shown on screens.

Fill out the form below, and we'll send you more information on Privacy Compliance.

Passwords are annoying and dreadfully insecure. There’s a better way, and it’s easy for you and your customers.

Journey’s approach to verification and authentication is fundamentally different than any other solution out there, enabling better security, privacy and customer experience across all interactions.

Fill out the form below, and we'll send you more information on Eliminate Passwords.

Robocalling killed outbound campaigns, but Journey has a new way to establish trust upfront, increasing connect rates up to 10x

Give your customers confidence that your calls are from a trusted souce, so they pick up when you need to get in touch.

Fill out the form below, and we'll send you more information on Improve Outbound Campaigns.

Ensure only your employees are sitting in front of their screens

Replace username and passwords with biometric authentication to gain entry to corporate networks.

Fill out the form below, and we'll send you more information on Secure Remote Workers.

Crush contact center KPIs with faster call handle time, better security and an award-winning customer experience

Unlock significant time and cost savings by making ID verification and authentication faster and far more secure.

Fill out the form below, and we'll send you more information on Contact Center Efficiency.

Journey’s secure payment solution vastly reduces the scope of compliance and eliminates card info on agent screens.

Our solution solves for PCI compliance and eliminates the need to send customers to a frustrating IVR system hoping they complete the payment.

Fill out the form below, and we'll send you more information on PCI Compliance.

Identity verification and everyday authentication create ultra high veracity identity in voice, digital and in-person interactions

Journey’s trusted identity solutions span the entire customer lifecycle and provide a seamless experience via voice, browser, enterprise app or in-person

Fill out the form below, and we'll send you more information on Seamless Authentication Across Channels.

Reduce the scope of compliance for the growing number of consumer privacy regulations, like GDPR, CCPA and HIPAA

Journey is architected with consumer privacy as a top priority. By making interactions “Zero Knowledge,” sensitive personal information is verified, but not shown on screens.

Fill out the form below, and we'll send you more information on Privacy Compliance.

Passwords are annoying and dreadfully insecure. There’s a better way, and it’s easy for you and your customers.

Journey’s approach to verification and authentication is fundamentally different than any other solution out there, enabling better security, privacy and customer experience across all interactions.

Fill out the form below, and we'll send you more information on Eliminate Passwords.

Robocalling killed outbound campaigns, but Journey has a new way to establish trust upfront, increasing connect rates up to 10x

Give your customers confidence that your calls are from a trusted souce, so they pick up when you need to get in touch.

Fill out the form below, and we'll send you more information on Improve Outbound Campaigns.

Looking for additional ways Journey can transform your business?